Peer-to-peer electricity trading and crypto in energy

Here are a few examples of the peer-to-peer projects I've found in Australia, and I'm sure there's some I've missed. If we were to look more widely we would probably find hundreds (no hyperbole) of similar trials and product launches around the world.

- RenewNexus industry trial in WA, using technology from Powerledger

- Latrobe Valley Microgrid, using technology from L03

- Allume Energy an energy sharing platform focused on embedded networks

- Nexergy a 'Neotailer' in the NEM

- Enosi a 'Neotailer' in the NEM

- AGL's Solar Exchange Product

- Local Volts, still getting ready to launch I think

- Probably more!

When you read articles or presentations that talk about an energy future with P2P at the centre, there is always a reference to blockchain. The two ideas aren't inextricably linked, and P2P solutions are being created that aren't based on blockchain, but for some commentators they have almost become synonymous.

I find P2P fascinating. There is an undeniable consumer interest in taking control and being self-sufficient. The big trend we are seeing in the power sector is a shift from centralised resources to distributed resources, and not just distributed in a physical sense, but distributed in an ownership sense. Instead of effectively being a 'renter' of energy resources, and being a disempowered price taker, solar and batteries allow a consumer to become an 'owner' of energy resources, and P2P provides the promise of being the price maker!

It's definitely something we should be paying attention to. But I also feel that the level of public discussion on P2P has been superficial. Here are some classic ways that peer-to-peer is promoted from a few articles I've just Googled. Inevitably there is no real detail beyond these kinds of high-level assertions.

"A groundbreaking rooftop solar trading platform that cuts out the energy market middleman and allows consumers to buy and sell renewable power at prices negotiated among themselves."

"The [P2P] system allows consumers to take advantage of other users who produce more energy than they need. Those consumers can sell their excess power for profit. The main advantages are: - No middle man – people make deals on their own terms - Everyone saves money - Transparent dealings directly with other consumers"

"Peer-to-peer energy trading presents an opportunity to unlock enormous value for consumers. It disintermediates the energy supply model, putting consumers in direct contact with other consumer"

"The aim is that consumers who purchase their energy via the [the platform] have the added benefit of getting their energy for cheaper than they would from the grid (and it's green!!) and local producers (prosumers) earn more than they would selling their energy back to the grid."

"The [P2P platform] has been designed to independently facilitate trading energy between peers using a combination of blockchain technology, IoT and artificial intelligence."

Does P2P really cut out the middle-man? Does everyone really save money? Is it really transparent? Are consumers really in direct contact with other consumers? And, does P2P depend on blockchain (or IoT? AI?)

I'm not an expert on P2P. I don't have any direct involvement in any of these projects or an insiders perspective, so this series two articles is just my attempt to reason about and discuss what really might be going on with P2P, and to hopefully get some feedback and ideas from other people to try and clear up any misunderstandings I have as I try answer those questions.

Enabling energy sharing

Peer-to-peer energy trading (P2P) is often characterised as being an example of the 'sharing economy', best exemplified by Uber and Airbnb. The idea of the sharing economy is that you can make money from selling access to underused assets: your car, your house, even designer clothes and powertools, or, in the case of P2P your solar panels and batteries.

I don't think the analogy to the sharing economy is exactly right. Consider that I have a car and a house, not shared on platforms like Uber and Airbnb, and, unsurprisingly, my neighbours don't use my car or my house (I hope!)

I also have solar panels on my roof that produce excess energy, also not shared via any P2P trading platforms, but I am a 'prosumer' because my neighbours do get to use the energy my solar system exports to the local electricity grid even though I'm not 'trading' with them.

It is electrical infrastructure and physics that enables energy sharing, not a coordination/trading platform layered over the top.

How much energy my solar system exports to the grid is entirely unrelated to the price I complete a trade, or whether I even find a buyer, on some hypothetical P2P platform. Similarly, who actually gets the energy my solar system exports to the grid is entirely unrelated to the buyer I might trade with. Nothing that happens on a P2P platform can directly influence how energy is shared, because P2P isn't the physical enabler of energy sharing and has no interaction with electricity flows.

To the extent P2P can have any influence on when and where energy is exported by one party and imported by another, it is only indirectly via behavioural economics (people changing behaviour based on incentives): "Perhaps if the price of energy is high right now, I will use less energy, so more power from my solar system is exported"; "If I can sell my excess energy for more money, I will install a bigger PV system". With the addition of batteries consumers can potentially start to get some direct control of when they might export, which we'll reason about how batteries fit in more when we try and work out the future of P2P.

P2P is really a direct competitor to the current way we provide an incentive for prosumers to export energy to the grid: the feed in tariff (FIT). It's just an alternative model.

So if P2P is all about economics, we need to look more closely at the current economics of electricity markets in Australia, but we'll need to do a detour first and talk about electricity retailers.

The role of electricity retailers

We generally just see the bills that retailers issue to us and so think of them as just doing billing (and "profiteering"; no one seems to like Retailers).

The traditional view of the electricity value chain was Generators → Transmission & Distribution → Retailers → Consumers. Then as we started to see more and more deployment of 'Distributed Energy Resources' we added a few backward/looping arrows to reflect 'prosumers' in the value chain.

But, unlike all of the other participants in the supply chain, Electricity Retailers aren't involved in the physical generation or supply of electricity. They are selling a product they never physically touch. Because of this, blockchain aficionados might describe Electricity Retailers as 'rent-seeking intermediaries' that are ripe to be disrupted. We'll figure out where blockchain fits in later

So, if they aren't involved in the physical supply of electricity what are they doing?

They are buying and reselling energy using existing 'peer-to-peer', if you like, physical and financial energy trading markets (e.g. NEM,WEM and ASX Energy, STTM, or making direct 'bilateral trades' with each other) but the 'peers' in these existing trading markets are around 150 generators and retailers and some liquidity providers/market makers, and not, for the most part, end consumers, as envisioned by P2P.

And the Electricity Retailers aren't just buying and reselling energy, they are also buying and reselling network services (transmission and distribution) and paying for metering, market operations, and environmental certificates (that fund renewable energy and energy efficiency incentive schemes). Retail electricity products are a bundle of these underlying services, of which energy is just one component of the bundle. Retailers turn these bundles into products they sell to consumers (including, for example, products that include a 'feed-in-tariff' as a component). One important characteristic these products generally have is simple, fixed pricing.

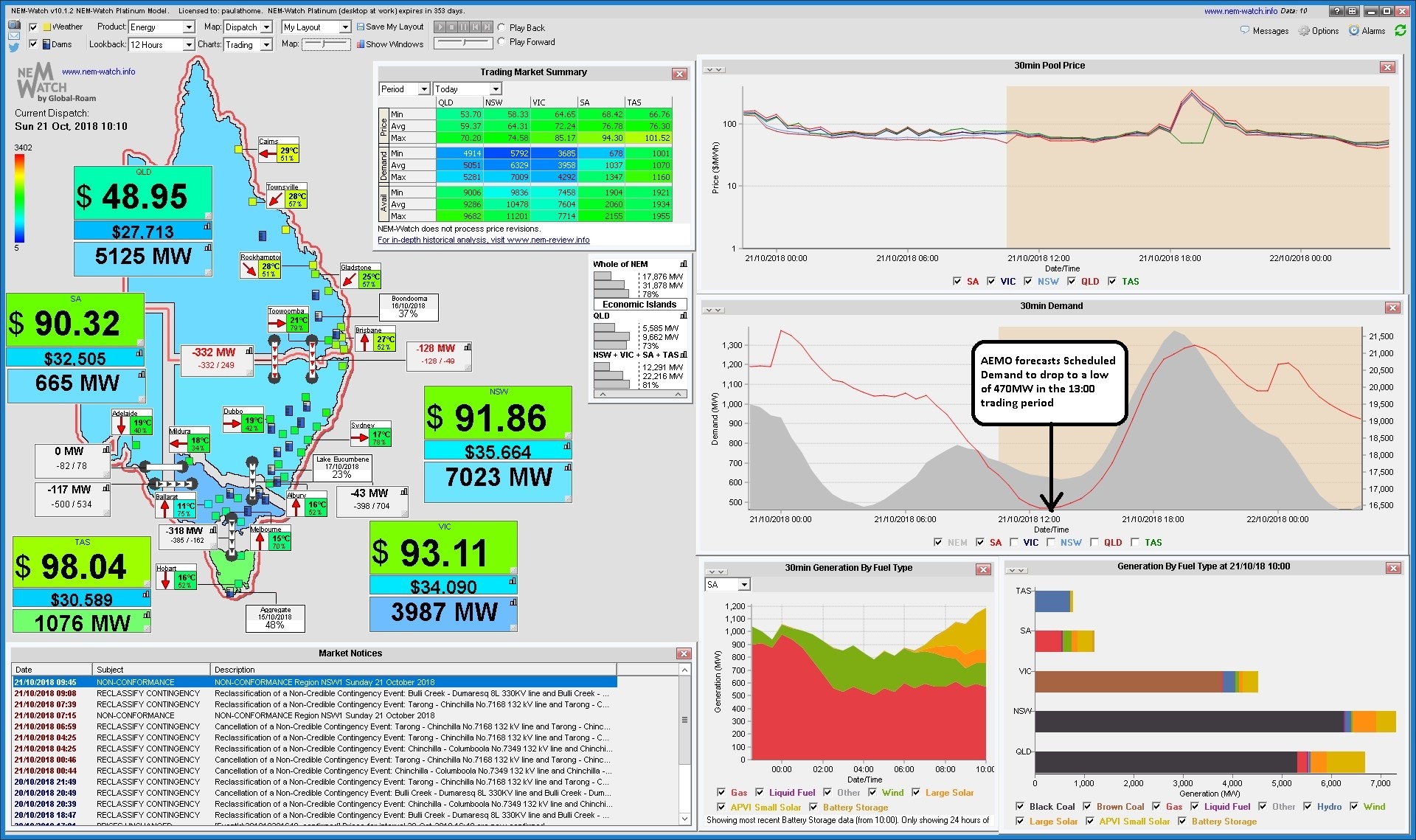

The underlying services Electricity Retailers are buying and bundling together are complex and exist within the context of multiple fairly dynamic markets: wholesale energy prices on the NEM can swing thousands of dollars per megawatt-hour in a 30-minute period (dollars per kilowatt-hour if you are thinking about it in terms of your household bill where you are paying cents per kilowatt-hour); in the WEM there is a capacity market, as well as short-term energy market and a balancing market (but with lower caps than the NEM); network tariffs can be very complex with different structures and charges in different geographic areas; environmental certificate prices are also volatile with price risk to be managed; even metering is often a competitive service with different providers offering different terms and prices; there are 'ancillary services' markets; demand response markets; financial markets with 'options' and 'derivatives' to hedge against volatile energy prices (swaps and caps and more); third-party insurance products to protect against extreme weather events that might drive up wholesale energy prices; and so on. It can get pretty complex.

They have one last extremely important job. They meet the prudential requirements of the market. They take on all the credit risk on behalf of the market. If the customer pays their bill late (or never pays their bill at all), the retailer still has to pay the generators and networks and everyone else who is providing the underlying services that the retailer is 'on selling'.

The working capital requirements for retailers are onerous, and the market operator is constantly monitoring the market positions of retailers, particularly in volatile market conditions, and can require retailers to demonstrate they have sufficient credit support at short notice. On the NEM, retailer failure is not uncommon and the regulator appoints a 'retailer of last resort' to take on customers when this happens.

So, on the one side they Electricity Retailers give consumers simple 'retail' products with fixed pricing; on the other side they manage risk and guarantee payment to the 'wholesale' market participants who are actually delivering services to the consumer.

The economic of P2P today

So with that context, let's return to the economics of peer-to-peer trading.

We'll have a go at working out the future of P2P later, but today it seems to only be discussed and promoted in the context of enabling residential customers to sell their excess solar for more than the feed-in-tariff offered by their retailer (or in some cases their embedded network provider).

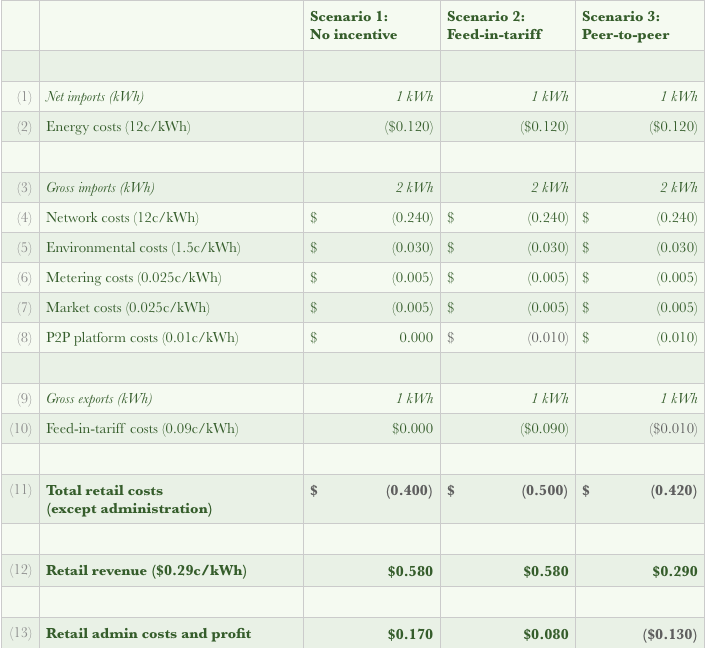

For the purposes of discussion, let's assume the 'average' residential bill cost-stack looks something like this, for a total average cost of 29c/kWh:

- Energy charges: 12c/kWh

- Network charges: 12c/kWh

- Environmental charges: 1.5c/kWh

- Metering charges: 0.25c/kWh

- Market charges: 0.25c/kWh

- Retail charges: 3c/kWh (admin, hedging, profit)

- Feed-in-tariff: 9c/kWh [paid for exports back to the grid]

When this cost stack is translated to a retail charge for a consumer, there is probably going to be a daily supply charge, but for now we'll just thinking about the economics based on passing through costs on a volume basis.

With those cost assumptions let's consider a few scenarios for Sarah Solar who has solar panels on her home, and Nora Neighbour, who doesn't. And let's consider a hypothetical 30-minute period on a sunny day somewhere in suburban Australia where Sarah is exporting and Nora is importing.

Scenario 1: In our first scenario there is no economic incentive for Sarah to export. Sarah is energy self-sufficient so pays nothing for her two units of consumption. Nora pays $0.58c to her retailer for her two units of consumption. The combined net cost for our two neighbours is $0.58.

Scenario 2: In our second scenario we have a feed-in-tariff of 9c. Sarah still pays nothing for her two units of consumption, but now gets paid 9c for the unit she exports to the grid. Nora continues to pay $0.58c to her retailer for her two units. The combined net cost for our two neighbours is down to $0.49.

Scenario 3: In our third scenario Sarah and Nora complete a trade on a Peer-to-Peer trading platform and settle on a price of $0.15/kWh. Sarah still pays nothing for her two units of consumption, but now gets paid $0.15 for the unit she exports to the grid. Nora only pays $0.29c to her retailer for one unit of energy, and pays $0.15 to Sarah for her second unit. The combined net cost for our two neighbours is down to $0.29 (just the 29c Nora is paying to her retailer for the unit that Sarah didn't supply).

Happy days! Compared to our first scenario with no solar export incentive, P2P trading has saved 29c (which could be hundreds of dollars over a year for our newly empowered consumers), and is better than our second scenario with a feed-in-tariff by 20c. So the question is where has that 20c come from? Peer-to-peer trading didn't create any new energy, so did it create new economic value in some other way?

By my way of thinking, the 20c consumer saving must come at the expense of an existing electricity market participant, so if this is going to be economically efficient we need to discover if and where it reduces the upstream costs in some way.

We also need to consider that there is one new increased cost to account for. Whether or not they are based on blockchain, P2P trading platforms have a cost to develop and operate, and the providers of these platforms have a profit motive. So when we revisit our retail bill-stack we will add in a $0.01/kWh administration cost for our P2P platform. Again, in practice this might not be passed on to the consumer volume based charge It might be a 'subscription fee' the consumer pays of say $30 per month, or a cost the retailer absorbs as part of their administration costs.

So to track down that 20c, let's look at the bill stack again from the Electricity Retailers perspective.

So in all three scenarios we have reduced the energy costs for the retailer on the basis of the energy that Sarah Solar is exporting (line 9), but all other costs have been retained on the basis they relate to the gross energy Sarah and Nora are importing from the grid (lines 3 to 8).

The total revenue the Retailers receives is based on the gross imports for Scenario 1 and Scenario 2, but is only based on the net imports for Scenario 3 (line 12). One way of thinking about the difference between the three scenarios is that with P2P, the Retailer only receives revenue for the net energy imported, because the gross energy is offset by the trades the two consumers make.

The net position (line 13) is that there is no margin left for retailer administration costs (or any profit) in the P2P scenario, and we have effectively just shifted value from the retailer to the consumer, and no new value has been created.

If we think back to the full set of underlying wholesale services the retailer is bundling into a product, the energy Sarah exports offsets only one of these costs for the retailer - energy - but none of the others. One obvious solution to this, that I think some P2P platforms are adopting, is for P2P to only apply to the energy component of the bill stack (although its generally not in the headline marketing). Effectively the other cost components can passed through to the consumer. This works but dramatically reduces the value proposition to the consumer, which is the big spread they perceive between the rate they are buying electricity and the rate they are selling their exported energy.

If P2P becomes 'energy only', the opportunity shrinks from say, up to 20c (29c electricity rate minus 9c FIT) to up to 2c (12c energy-only rate minus 9c FIT plus 1c P2P platform charge). But then P2P is just not that compelling. If you then add in the time (and hassle?) for the consumer to actively engage with the P2P platform then it's hard to see this value proposition as being compelling for all but the most engaged and tech-forward energy consumers (most residential consumers don't even look at their bill), when compared to what they might get from a feed-in-tariff. And if the consumer is in a market with competitive retailing and there is value being from solar exporting being left on the table, then competition should drive retailers to offer a higher FIT, sharing some of that value with the consumer, to be competitive.

But even for energy-only P2P there is some additional complexity and risk to consider. Our assumption of an average retail cost price of 12c per kWh for energy might not be correct at the actual times when the P2P consumers are actually trading.

Wholesale energy prices

The actual wholesale energy costs for the interval in question could be much lower than 12c, as low as negative $1/kWh on the NEM (i.e. you have to pay a $1 to export energy to the grid) up to positive $14.5/kWh. Note the price caps are much lower on the WEM.

It's hard to examine the interplay of P2P with wholesale energy in the simplistic model we've been considering above as Electricity Retailers will generally be hedged against super high prices (i.e. establishing there own 'cap' of say $200/Mwh so they aren't exposed to the market price cap of $14,500/MWh on the NEM). If we were to try and do this properly we'd have to start taking into account the fact the retailers will have bilateral contract positions with some generators that fix the price they are paying for energy irrespective of movements in the wholesale market, they will have financial contracts in place to hedge against high prices (caps), and they may be able to draw upon other resources like demand response to manage price risk, and so on.

And of course we do have what some people describe as an oligopoly in Australia where our biggest retailers own lots of power stations (or our biggest generators are also retailers, depending on your perspective), which means that high wholesale energy prices aren't just a retail cost risk, they are a wholesale revenue opportunity. And there is further complexity that many market participants are still Government owned, and the Government has been known to put their fingers on the scale. But for the purposes of this discussion, let's imagine we live in a pure market world (and remember that many smaller retailers do in fact live in this world).

While high wholesale energy prices can be problematic, let's focus on low and even negative wholesale energy prices. The times of day that Sarah Solar is able to export probably coincide with times when other roof-top solar systems are exporting and when we are getting maximum output from the 'solar-farm' power stations that are connected to the grid. That is the times of day when energy on the grid is more likely to be in surplus and energy prices are more likely to be low.

It happens that large-scale renewable energy generators (solar and wind power stations) are happy to 'bid into the market' at negative prices because they benefit from 'LGC' revenue (the incentive we provide to help Australia meet its renewable energy target, which energy consumers pay for via environmental certificate schemes). So even if the wholesale market is saying their energy isn't required, and is offering negative prices, it is profitable for large-scale renewable energy generators to keep producing. In these low or negative wholesale price environments conventional thermal generation will still be producing some energy because they can't quickly ramp up and down, and because they are required to provide other services to the grid besides just energy.

We are now regularly seeing negative wholesale energy prices in the middle of the day on clear sunny days in South-East Queensland and Western Australia, and this is a trend that will only continue as the penetration of solar inevitably increases.

So let's imagine Sarah and Nora live somewhere with these market conditions, and for this hypothetical 30-minute interval we've been considering, let's imagine the wholesale energy price was negative $150/MWh (-15c/kWh). So now in our P2P scenario the Retailer has to pay 15c for the unit Sarah exported (it's a liability the Retailer is responsible for in the wholesale market, even though Sarah is trading with Nora); is continuing to be financially responsible for all of the services Sarah and Nora are using, like the use of the distribution network and having capacity available for those intervals when Sarah can't supply energy to Nora; but is not receiving any revenue for the energy Sarah exports or that Nora imports.

For our Scenario 3 above, it brings the Electricity Retailers net position down from negative 13c to negative 28c. Again, this might seem like a small number but this is for just one 30-minute interval and just one trade between just two consumers. If we are hoping for large-scale adoption of P2P, these numbers will get big very quickly.

One possible response to our hypothetical retailer losing money might be, "Good! Stuff the retailers." But that is not economically sustainable; markets and regulations would respond, and rate structures would change such that either Sarah and Nora pay their fair share, or other consumers end up paying it for them (e.g. increased 'daily supply' charges). That is, we end up just socialising the cost of that 'saving' across other energy consumers.

Another response might be "Hey, what about the networks?!".

So, what about the networks

We haven't shown any change in network costs in our scenario, which does reflect the facts of the current situation given current network tariff structures and market rules. The fact that Nora used some locally generated energy from Sarah doesn't change the network costs the Electricity Retailer will actually incur for either of them.

One of the big arguments for encouraging more local generation with P2P trading is that it reduces the costs and losses associated with transmitting energy over long distances from large centralised power stations. So following this argument, we should reform network tariffs to incentivise local generation, and maybe that would make P2P more compelling?

One way that has been proposed in the past to encourage local generation is the idea of 'local generation network credits (LGNCs)'. The idea was that networks would pay 'prosumers' a credit that reflected the estimated long-term benefits that they provided in terms of deferring or down-sizing network investment, or reducing operating costs.

The networks made the case in return that local generation doesn't reduce their costs. They said that LGNCs would effectively just increase costs to other consumers, while offering little or no deferral of network investment. Networks have a regulated return on capital guaranteed, so if their costs go up, effectively these costs are just shifted to the consumers who aren't benefiting from LGNCs; consumers who may be less able to bare them than the kinds of consumers who are installing large solar systems and who might embrace P2P.

One big difference between this line of thinking and the conventional value proposition for P2P, is that there is a clear statement about how new economic value might be being created (LGNCs: local generation reduces network costs), and not just value be being shifting around (P2P: just get paid more for exporting). So whether or not you accept the networks arguments about local generation, and many don't, if you were to reform network tariffs in this way, and that provided a real economic benefit from having more local generation that was shared with consumers, then do you really need peer-to-peer trading?

It begs the question: what are we trying to achieve with P2P, and are their other mechanisms we should also be considering as alternatives or complements to P2P.

Up next ##

I would love some feedback: fabian@dlgb.net 🙋♂️.

This article is my attempt to reason about and discuss what really might be going on with peer-to-peer electricity trading in Australia (P2P). My goal is to share my thoughts, but to also to provoke some feedback and discussion. P2P is enticing and exciting, and is almost certainly part of the 21st century power-grid, but in what form?

P2P isn't a physical enabler of energy sharing (my neighbour still gets the benefit of my excess solar with or without P2P platforms), and, right now at least, it's really just an alternative mechanism to a feed-in-tariff (more complex, but potentially more engaging and empowering for some consumers).

We need to examine the role of electricity retailers: they bundle together wholesale services into simple retail products with fixed pricing, and they manage price risk for consumers and credit risk for the market.

Looking at the economics of P2P, it appears to just shift around value and any apparent benefit to consumers who use a P2P platform would either be very small (low single-digit cents per kilowatt-hour, and so possibly entirely offset by service fees associated with the use of a P2P platform), and would necessarily have to be at the expense of the retailer, and ultimately other consumers, as the market responded (there is no free lunch).

In response to this problem of no new value being created by P2P, we can consider the case of the network and note that if P2P encouraged more local generation and consumption, then it would reduce the costs and losses associated with transmitting energy over long distances from large centralised power stations.

However, given the way electricity markets work in Australia today, that would require a change to network pricing (like introducing the notion of local generation credits), and if network pricing was reformed you arguably don't need P2P to help capture the value.

Let's look more closely at the specific challenges P2P might help us address.

The challenges we face

Innovation is great, but we should always be wary of solutions that are looking for a problem. So what specific problems might P2P solve?

- High-voltage transmission of electricity is inefficient (due to losses) and expensive; how might we encourage and enable more local generation?

- Climate change is an existential threat; how might we reduce greenhouse gas emissions from our current dependence on coal and gas power plants?

- Not all energy consumers have the capacity to self-generate; how might we help them to benefit from roof-top solar PV and access greener and cheaper electricity?

- Solar and batteries provide the potential for energy consumers to 'defect' from the power grid (increasing costs for those who can't); how might we encourage more people to stay connected?

- Renewable energy is cheap but isn't dispatchable; how might we empower and enable consumers to be more flexible with when they produce and and consume electricity?

Have we missed any?

1. Lowering network transmission costs

This is one we've discussed, but for completeness, if more electricity is generated and consumed locally, then we can reduce the losses and costs associated with building and maintaining expensive high-voltage transmission infrastructure.

Peer-to-peer electricity trading could potentially offer consumers more incentive to install larger PV systems and so drive more local generation.

However, as we discussed, capturing this value of requires changes to network pricing to recognise the value being created, and with if network pricing was reformed you arguably don't need P2P to help capture the value.

2. Lowering greenhouse gas emissions

If more people install their own renewable generation system (e.g. roof-top PV), and meet more of their electricity needs from self-generaion or local generation, then there will be less generation from polluting coal and gas power plants.

Peer-to-peer electricity trading could potentially offer consumers more incentive to install larger PV systems. However, as we discussed, unless we can show how P2P creates new value in some way, this just shifts the costs associated with current power grid to other consumers, and so is effectively just another form of cross-subsidisation.

However, we already have feed-in-tariffs, which are functionally very similar to P2P, at least as it relates to exported solar PV, and we already have the renewable energy target (RET), which subsidises installation of small and large-scale renewable energy.

The combination of RET and FIT, and our fantastic solar resources, has already led to Australia having the highest rate of residential rooftop PV deployment in the world.

If we want to accelerate up-take even more, then increasing the RET target is arguably a much simpler solution than providing a trading platform.

3. Supporting those who can't self-generate

Not everyone has the capacity to install their own solar PV: they don't have the physical space (e.g. tall buildings), they don't own or control their roofspace (e.g. renters), or they don't have the up-front funds required to purchase a system outright.

And even for those that can install solar PV, perhaps they are limited in how much they can install and want the ability to purchase more renewable energy.

Peer-to-peer electricity trading could potentially offer these consumers the ability to buy solar from their neighbours; supporting more local generation, as an alternative to self-generation.

However, there are a number of existing solutions to this challenge:

- Leases and other forms of financing agreements to fund installation of a solar system (that is typically owned by the consumer at the end of the financing agreement)

- Greenpower (environmental certificates) allows consumers to support renewable energy projects and effectively offset the emissions associated with the electricity they consume. They can do this by purchasing a Greenpower product form their Electricity Retailer (electricity and certificates bundled together), or they can can source and surrender their own certificates.

- Power purchase agreements (PPAs) (an agreement to buy solar power from a system owned by a 3rd-party; could be on-site or off-site) allowing consumers to directly purchase the output from a renewable energy system (where the output is electricity, enviornmental certificates, or both)

- Fractional-ownership (owning a part-share in a solar or wind asset) and community owned renewable energy (cooperative based models of renewable project development) allow consumers to directly invest in renewable energy projects.

The difference between the last two is that with fractional ownership you are purchasing an ownership share in an asset and thus a share of future cashflows (financially offsetting your direct electricity costs if you want to see it that way). Where as with a PPA where you are purchasing the electricity output from an asset owned by a third-party (who in Russian dolls fashion could be a local community who invested in developing the asset!)

While there are some good solutions in place, they aren't necessarily easy to access so this is a challenge worth exploring further as we look for a role for P2P, particularly when the consumers goal is switch away from electricity generated using fossil fuels.

However we need to keep in mind that the main financial benefit of 'self-owned' solar PV is 'self-consumption': by owning the asset you avoid the ongoing cost of purchasing electricity from generation plant and network assets owned by others. P2P doesn't deliver this and buying electricity generated by your neighbour won't be any cheaper than buying electricity from anyone else (absent some theoretical saving on network costs as discussed under Item 1, above).

4. Preventing grid defection

In Australia, electricity you generate yourself is always cheaper than electricity you purchase from the grid. We are already seeing 'load defection' and consumption of electricity from the grid in Australia has been declining since 2008 as a result of behind-the-meter solar and energy efficiency.

With the addition of storage, consumers have the opportunity to be fully independent of the grid and at the point that the cost of electricity from solar plus storage is cheaper than electricity from the grid, consumers may defect entirely.

As this defection proceeds, the relatively fixed costs of maintaining the power grid (both with respect to network and generation capacity) will need to be shared across a smaller and smaller pool of consumers who now have a greater and greater incentive to defect themselves (if they can). This is sometimes called the 'death spiral'.

Peer-to-peer electricity trading could potentially help prevent the 'death spiral' by providing an incentive for consumers to stay connected to the grid because of the revenue opportunity to sell their excess energy to other consumers.

However, there is some additional complexity to consider. Some of the risk of grid defection will be addressed through pricing reform. In the 20th century more than 60% of the cost of electricity was generation, and 80% of that was the cost of fuel. As a result we charged for electricity based on the volume of energy that was consumed (cents per kilowatt-hour).

We're now in a world that is trending towards zero fuel costs, and most of the cost of electricity is the up-front cost of building and then maintaining infrastructure that provides sufficient network and generation capacity to meet maximum demand requirements, and a world where the underlying price of electricity is much more volatile.

We need to start moving to pricing models based on the real underlying cost drivers, and not based on the volume of electricity used with a flat rate or simple time-of-use rates. When we do this (which is dependent on political will and consumer education and engagement) it will ameliorate some of the risk of the death spiral.

In a future world where consumers are exposed to more demand/capacity based charges and/or more dynamic volume based charges, feed-in-tariffs would also need to evolve and a simple flat-rate won't be appropriate. As discussed in Article 1, households will tend to have excess energy to export at the same times of day, and at the same times of day we are getting maximum generation from solar farms on the power grid, i.e. the value of the energy will often be very low, or even negative in some cases. But commensurately there will be times when energy is very expensive and households should be rewarded if they can export energy at these times.

This kind of pricing reform might seem very prospective for P2P, but it depends on how the market is reformed, and the way incentives are provided for other forms of demand side management.

Batteries are one tool to give customers more flexibility to manage when they import and export electricity, but they don't fundamentally change the calculus for P2P. Even in a market where most prosumers have batteries and are exposed to more dynamic price signals (via their retailer or some P2P platform) they will still be generally motivated to maximise their self-consumption of solar and minimise their maximum demand, rather than focusing on export to the grid in response to high-price events.

This is because to have an efficient payback on your battery investment, you need to be using your batteries full capacity consistently every day: that is, charging it when your solar system is producing or overnight when prices are low, and discharging it every day into the early evening peak when your solar system stops meeting your energy requirements. It is difficult to do this consistently and retain flexibility to respond to high price events, because batteries don't charge and discharge instantly and have a limited capacity.

The other challenge for a P2P is that at critical times, whether a customer provides additional capacity by exporting, say, 5kW of power, or curtails their demand by 5kW, then they are delivering exactly the same value to the power grid, but P2P, at least in the current form I've seen, is only well placed to reward the first of these.

This is because when we focus on the first case, exporting energy, we can 'pretend' that the energy we have exported is going to specific consumer who we have completed a trade with on a P2P platform (where as in practice it is spilling into a local pool shared across multiple consumers). However in the second case, and with other kinds of non-energy services we might provide we can't easily trade with a single counter-party, without enormous additional complexity.

Yet in this future world this second case is likely to be where most of the value to the grid lays, and thus most of the additional reward for not defecting.

5. Delivering more flexibility

The transition to 100% renewable energy on the power grid is inevitable, it's just a question of ambition and timeframes. Not only do renewables help us address the climate crisis, they are already the cheapest way to generate electricity in Australia (for new assets), and only getting cheaper (soon the cheapest even compared to existing fully depreciated assets, even when we account for firming costs).

We still only have a relatively modest penetration of renewable energy on the grid, but it is already causing stresses. Markets are dealing with more volatile wholesale energy prices. Grid operators are facing challenges with grid inertia and frequency and voltage control. The business models (and maintenance budgets) for operators of older thermal power stations are being challenged by the need to ramp up and down more frequently. And, electricity markets and regulations are undergoing rapid reform to respond to these challenges.

As energy gets cheaper and cheaper, there are other costs to pay: we need the ability to store energy, we need the ability to quickly ramp down (and up) demand, and we need new sources of voltage and frequency control.

Peer-to-peer electricity trading could be a solution to recruit consumers to help provide these services. However, as discussed above, this is a more complex world, and the value proposition for P2P needs to evolve beyond being a (supposedly) more lucrative feed-in-tariff for exported solar.

Perhaps what is required is what is sometimes called the 'transactive grid', which enables consumers (and their assets and devices) to participate more dynamically within the power grid. This could potentially encompass peer-to-peer electricity trading, but it entails a great deal of complexity and a need for real-time automation, perhaps this is where blockchain comes in?

A blockchain for energy?

Blockchain is definitely one of the most interesting and potentially transformative software technology innovations of the last decade. But I am often set on tilt by marketing speils that ascribes almost magical properties to the technology, with buzz-word salad, and claims it will deliver astounding benefits to the energy sector.

"Blockchain technology's relatively low transaction costs allow smaller energy producers to sell excess energy, thereby increasing competition and grid efficiency. Smart contracts facilitate the real-time coordination of production data from solar panels and other installations, and execute sales contracts that allow for two-way energy flows throughout the network."

"The use of blockchain means that the market can be real-time, transparent, scalable and above all, frictionless , creating trust between all involved parties."

"Blockchain can allow system operators of distributed generation to optimise grid operation by managing all connected devices through automated smart contracts, enabling flexibility and real-time pricing."

"Blockchains, in combination with artificial intelligence (AI) techniques such as machine learning (ML), can identify consumer energy patterns and therefore enable tailored and value added energy products provision."

"The blockchain promises a transactional platform that is highly secure, low cost, fast, with lower incidents of error, and the possibility of reducing capital requirements."

"By facilitating and accelerating IoT applications and enabling more efficient flexibility markets, blockchains could improve network resilience and security of supply."

"Through smart contracts, blockchain can directly and automatically control the network flows as well as energy storage. In the same manner, blockchain through smart contracts can be used to balance activities and virtual power plants."

"With the emergence of blockchain (a protocol that eliminates intermediaries), it is possible to establish an auditable encrypted ledger that can record energy consumption, credit histories (which are relevant when there is a need for access financing), as well as provide energy trading between households; giving consumers more control of their energy requirements and consumption."

"What blockchain also unlocks is security. As modern electrical grids introduce computers, smart meters and sensors it can be prone to malicious intrusion or attacks. There are now cyber threats surrounding data management and transactions that blockchain can overcome."

I'll say off the bat that I think most of the claims are hyperbole at best. In most cases the claimed benefits just aren't related to the inherent qualities of blockchain technology itself, but instead to a broader digital innovation opportunity (that could also be realised with other technology options).

Blockchain technology is a very specific thing with specific characteristics, and with concrete advantages and concrete disadvantages. Some of the quotes above are actually claiming as advantages things that are actually disadvantages of blockchain technology.

So let's dig into exactly what is a blockchain and how it works in general; then how might it actually work within the energy industry and how it relates to peer-to-peer trading.

So what exactly is a blockchain?

Lets start with a definition from the US National Institute of Standards and Technology, which defines a blockchain as follows (pdf):

"Blockchains are distributed digital ledgers of cryptographically signed transactions that are grouped into blocks. Each block is cryptographically linked to the previous one (making it tamper evident) after validation and undergoing a consensus decision. As new blocks are added, older blocks become more difficult to modify (creating tamper resistance). New blocks are replicated across copies of the ledger within the network, and any conflicts are resolved automatically using established rules."

The key idea here is that a blockchain combines (1) a data structure that makes it very efficient prove that historical transactions have not been modified, with (2) ways of replicating valid transactions across multiple copies of the data so that everyone's copy of the data is eventually valid and consistent.

I can have my own copy of a shared ledger. I can update my copy with a new valid transaction, and I can be confident that eventually everyone will have that transaction recorded in their copy of the ledger, and that it can't be modified. This model has the useful benefit that it allows two parties, who need not trust each other, to deal with each other directly — trade electricity, transfer a share in a wind farm, etc — without needing to deal via an intermediary.

In the context of a blockchain for peer-to-peer electricity trading, that ledger could be a log of trades (I bought 10 kWh from you for $5), and, perhaps in theory, with such a blockchain we can do away then do away with intermediaries like a market operator (e.g. AEMO) or market representative (e.g. your retailer).

In the context of a blockchain for fractional ownership of an asset like a wind farm, that ledger could be a log of share transfers (you transferred a 5% stake in the asset to me for \$1000), and, in theory, we could then do away with a licensed fiduciary to manage the investment scheme.

In the context of a blockchain for tracking renewable energy certificates, that ledger could be a log of generated certificates and transfers of certificate ownership (this windfarm generated 10 certificates; those 10 certificates were transferred to me; I surrendered those 10 certificates to offset my greenhouse has emissions; etc), and then perhaps, in theory, we could do away with the need for a government registry.

However this benefit of doing away with an intermediary comes at a cost.

Everyone (*) has to process and store a copy of every transaction (* well everyone depending on the extent to which the blockchain is actually public and decentralised). And further 'proof-of-work', the most (some would argue only?) secure and resilient consensus mechanism for blockchain is, by design, very computationally expensive. So blockchain based solutions are necessarily less transactionally performant and efficient than alternative more centralised solutions.

And there is one other cost, or feature, depending on your trust in the state and regulated institutions. If you and I deal with each other via a bank, we are both known to the bank (we both have an identity the bank can verify and an account with the bank). If I forget my password I can ring up the bank and get it reset. If transfer some money to you by accident (I fat finger an account number), I can ring up the bank and get that reversed.

In the blockchain alternative in theory there is no bank as intermediary — you are 'self-sovereign'. This means there is no one you have recourse to when things go wrong. If you lose your 'private key', you lose your identity and your money, or what ever other asset or entitlement is recorded on the blockchain (in the case of cryptocurrencies, individuals have lost millions of dollars for this reason).

That's more or less it. Or it was until Ethereum came along.

Initial Coin Offerings and Decentralised Autonomous Organisations, Oh My.

The existence proof that we can build safe, useful, enduring platforms on blockchain technology is Bitcoin. Bitcoin is peer-to-peer digital money. While the primary application of Bitcoin is money, you potentially can build other kinds of quite interesting applications on the Bitcoin blockchain, perhaps including applications for energy (see for example prediction markets on the Bitcoin blockchain; also scripts, colored coins, lighting network, and multisig).

But what really motivated people to apply blockchain to a wide range of applications beyond money was Ethereum. Technically, Ethereum's main innovation was providing Turing complete "smart contacts" (simple computer programs that would execute on everyone's copy of the ledger). But what really sparked the cambrian explosion of new blockchain applications was the idea of creating and selling special purpose 'tokens' with associated smart-contracts to manage their use (as at at the time of this writing, there are 182,771 ERC-20 token contracts on the Ethereum blockchain, and some non trivial percentage of these will have something to do with energy).

Token sales provided a new approach to capital formation for new ventures — rather than sell equity in your new venture to a limited number of accredited investors, you could sell tokens to anyone in the whole world who saw future utility in the new platform you are building.

For example, given a platform for decentralised investment in expensive artwork, the associated token would be an entitlement to a share in some artwork. Given a platform providing decentralised data storage, the token would be an entitlement to store some units of data. Given a platform providing decentralised peer-to-peer electricity trading, the token would be an entitlement to some units of electricity.

To the extent that the blockchain platform would provide value, there would be demand for the services of the blockchain (shares in artwork, data storage services, generation of electricity, etc.). To the extent there was demand for services these tokens would have value because people would need to purchase the tokens to to use the services. To the extent that tokens had value that could be exchanged back to bitcoin or fiat currency, demand would drive a corresponding supply of the required services.

There was also a view that once 'coded' with smart contacts, and with a working token economy, these platforms might become like autonomous organisations, acting without any human intervention and without any 'rent seekers' in the middle taking a clip on every transaction.

In this conception of 'decentralised autonomous organisations', the way the developers of these platforms would be rewarded for their work to establish the platform and their ongoing work to maintain it was by selling down a 'treasury' of tokens they retained from the initial token sale (rather than benefiting from the cashflows generated by the use of the platform as with typical entrepreneurial ventures).

So we have a decentralised ledger that allows parties to deal with each other without going via an intermediary. And we potentially also have a 'token economy' to help motivate suppliers and consumers to deliver services to each other on a decentralised platform.

How do we get from there to the breathless list of benefits of blockchain technology to the energy sector we started with? Autonomous, efficient, real-time, frictionless, no intermediaries, smart contracts, instant settlement, more secure, etc, etc. There are some practical challenges to overcome, and some related philosophical concerns we need address.

Leaving the digital realm ...

One of our first challenges is that electricity is a physical commodity, which we generate, measure and manage with physical equipment. This is in stark contrast with digital money, which isn't.

Bitcoin and other cryptocurrencies are 'digital assets': we can instantly and accurately identify who owns a particular asset by simply inspecting the ledger. We can transfer ownership of the asset entirely on the ledger. We don't have to trust anyone or anything beyond the ledger.

Consider the difference with physical assets. Say I want to buy a half-share in an Banksy painting from you that is on an 'Art Blockchain'. Once I complete the transaction with you I can proudly admire the digital rendition of the artwork. But this isn't a cryptokitty, there is supposed to be real painting some where. Where is it? Who is to say it ever really existed in the first place (or that it hasn't recently self-destructed?). This is sometimes called the Oracle Problem.

You might say there is a GPS tracking device and a digital camera trained on the painting uploading its image and position to the blockchain every 5-minutes (remembering all this data needs to be replicated to all the nodes on the blockchain so they can all execute the, say, Transfer Shares Smart Contract that has to verify the painting still exists before the 'Art tokens' change hands).

But someone could feed erroneous data to the blockchain, and while we might start concocting increasingly elaborate schemes for feeding multiple redundant streams of data about what is happening in the real-world, and algorithmically analysing the data to detect fraud (AI!, IOT!), the problem is pretty fundamental and never really goes away.

The simple answer is that if ever there was a dispute in relation to the location, ownership, or integrity of the physical paintings being tracked on this Art blockchain, we're going to be looking at traditional contract law and the court system to resolve the issue — which can influence the real-world in a way that smart contracts can't.

Unlike our hypothetical 'Art Blockchain', in the case of Bitcoin, I can download and run my own 'Bitcoin node' and start trading with others without permission from anyone, and without having to trust anyone, and without anyone having to trust me (e.g. trust that the painting I registered on the blockchain is actually real).

If we return to peer-to-peer electricity trading we can see similar dynamics. I could perhaps download my own 'P2P node' for a P2P blockchain, but I would need a power meter sending data to the blockchain, and everyone I traded with would have to trust it (and trust me that it wasn't just a script running on my computer pretending to be a meter).

Aha, you might say, this isn't really a problem. In Australia we have (some) smart meters; we have a good system of accrediting and auditing the third-party providers of meter data; we have strong standards around suitable meters, including for example tamper prevention and detection; we have standards in relation to the format of the meter data; and, rules about who can access the data and how it is distributed; rules to ensure data privacy, and so on.

But to the extent we rely on this existing centralised infrastructure, we are starting to undermine the main (only?) real advantage of blockchains over more traditional software platforms, which is decentralisation.

So with blockchain-based peer-to-peer electricity trading in Australia we probably aren't going to be running our own nodes, we won't all have our own copies of the ledger, and we won't be trading directly with each other without the involvement of any intermediaries or third-parties (i.e. we probably won't have a public blockchain solution).

The Oracle Problem is one of the reasons why, and we'll go on to talk about some others.

Public or private?

Before we do, let's side track into the public versus private debate.

The conceptualisation of blockchain I described above is the 'public permissionless blockchain' ideal originated by Satoshi Nakamoto who wrote the original Bitcoin Whitepaper.

The entire goal was to cut out intermediaries and allow people to trade directly with each other without needing permission (you don't need to register an account with anyone; there is no one to grant you access; the software you are running is open-source, with a choice of implementations, or you could even write your own).

One of the downsides of this model, as we've discussed, is that there is a much higher computational and data storage cost than with traditional databases. We pay for these costs in the time it takes for transactions to be completed, and in fees to pay for the completion of the transactions.

Another downside is that all the data on the blockchain is public, and while there are techniques to maintain confidentiality on public blockchains, these add cost and complexity. And for these public blockchains, ownership and control of the technology is complicated and can lead to the problem of forking.

One response to this is to create permissioned and/or private blockchains that are effectively owned and controlled by some entity, or some consortium. This is what the Australian Stock Exhange is doing with Blockchain, for example.

With this approach you control who can read from or write to the ledger, you can can make the validation of transactions much faster, and you can have much more control over changes (and you can keep your source code private). But to the extent you do this, it stops being anything like Bitcoin or Ethereum.

In fact I think that if you are thinking you'll use a private blockchain, you might find one of a myriad of commercial and open-source databases suit your needs just fine. If you can coordinate with and trust all the participants running your software, much of the motivation for a blockchain, and the need for consensus models based on proof-of-work or proof-of-stake, go away.

There are many options with non-blockchain database technology to pick and choose the desirable features of blockchain that you might like for your application, such as a distributed architecture with replication across a network to multiple redundant nodes, immutable append-only tables, use of public-key infrastructure (PKI) and cryptographic signing of transactions, etc, etc.

The point is that while you might still technically, under-the-covers, be using a blockchain data structure, or a merckle-tree structure, or just plain old public-key cryptography, marketing your platform as Blockchain!! is just that: marketing. You really just have a private centralised software platform, and that's okay.

Guess Who

Another problem with public blockchain we've alluded to relates to identity management. One of the most important technologies underpinning blockchain is public-key cryptography.

This technology allows you to sign your transactions with your private key and allows others (including scripts/smart contracts) to verify this using your public key.

You may have heard of 'wallets' in the context of cryptocurrenies like Bitcoin and Ethereum. These wallets don't actually store your tokens, they store your private keys. A 'wallet' can even just be a piece of paper with a private key written on it. Wallet software just makes it easy to execute transactions on the ledger using your private key and helps you keep your keys secret.

I'll hazard a guess that, today at least, no blockchain-based peer-to-peer electricity trading platform is making end-users actually use a wallet. They will likey be acting as the custodian for peoples keys and authenticating people using more traditional 'username' and 'password' and 'send me an email to reset my password' security (i.e. using a centralised software platform that is wrapping the now unnecessarily decentralised blockchain).

This is because public key cryptography is really untenable for real people. The user experience is a disaster and people, in practice, lose their keys.

This might be addressed in one of a few ways:

- In time we may have better wallets and more familiarity within the broader community of this way of interacting with digital platforms for other applications;

- The Government might solve this by providing everyone with digital identities including generating and managing, and storing key-pairs for people (this will make the crypto-anarchists cry);

- We may abstract away the key management into smart hardware devices, like a new generation of smart meters or intelligent monitoring and load control devices sitting within our properties, which interact with these platforms on our behalf (AI agents?);

- We may rely on intermediaries like aggregators and retailers managing interactions with energy blockchains on our behalf.

I think the last of these is the most likely for any kind of mass market adoption, at least for the next decade or two.

Security, security, security

This brings us to some other security related challenges. One of the frequent claims about blockchain is that it is extremely secure.

In fact some pundits claim blockchain will 'solve' cyber-security for the sector and will stop Russian hackers from being able to bring down our power grid (they have form). In one respect this security claim is well founded. Bitcoin has been around for over 10 years, with a prize for 'hacking it' in the billions of dollars that no one has been able to claim.

There are a few buts.

Firstly, the Bitcoin blockchain has unique scale, having more nodes processing more transactions make blockchains harder to attack, and much of Bitcoins security derives from its 'proof-of-work' consensus model.

This is somewhat controversial in the clean-energy sector where people frequently decry the waste of Bitcoin mining. The problem is the security of Bitcoin derives from this high-energy use — it is a feature not a bug — the energy requirements make it computationally and economically infeasible to attack the network.

So while Bitcoin has proven to be very secure, it's not clear that smaller networks with different consensus mechanisms will be as secure, or at least there will be different risks to consider.

Secondly, despite the Bitcoin blockchain never being hacked, many users of the blockchain have been. People have had their coins stolen by having their keys stolen or by being defrauded by exchanges who had custody of their coins.

Blockchain technology is suseptible to many of the same attacks as conventional software technology, and stories of hacks are not uncommon. Some of these attacks are ones the software industry is already familiar with like social engineering, and others are new and unique to blockchain, like 51% attacks, or just losing your private key.

So there is nothing magical or guaranteed about blockchain security.

Real-money please

Power stations and transmission networks cost 'real-money' to build and maintain. When I sell electricity to my neighbour I want 'real-money' in return.

For most people 'real-money' means the fiat currency they can use at the shop on the corner, but many digital currencies could count too: they have been legitimised as a safe store of value and a working medium of exchange.

What doesn't count are "artcoins" or "electrade" tokens or whatever utility token has been invented to enable the 'token economy' for some Dapp or DAO (decentralized application; decentralized autonomous organisation). These utility tokens are like 'store credits' or 'loyalty points' that can only be used to access services from the company that issued them (while that company is still in business). For our Dapp or DAO we need some way to exchange our utility tokens for 'real-money' for this all to work.

Luckily we have businesses that will facilitate this exchange called, wait for it, Exchanges.

Before we call 'job done' (and without going down the rabbit hole of the suspect business behaviour and many hacks associated with crypto-exchanges), lets talk about one of the most important benefits of blockchain technology for peer-to-peer electricity trading, which is in enabling 'instant settlement'.

The idea here is that by using blockchain technology we can complete our transaction instantly and entirely digitally (exchanging an asset for some representation of value as a single transaction on a blockchain). This is in stark contrast to the dance in the real-world, for example for many phyiscal goods and business services we have purchase orders, delivery receipts, invoices, financial payments, remittance notices, cash reconcilliation, etc, and a process that takes weeks to complete.

This challenge of managing market settlement and the associated issue of credit risk is what, in part, motivates the need for two of the intermediaries in electricity markets: the market operator and electricity retailers. And as we discussed in Article 1, the costs of meeting the markets prudential requirements and long settlement times are very significant, so this is an opportunity worth tackling.

So how quickly can a blockchain based peer-to-peer electricity trading platform take me from (a) I just sent out some electricity to (b) buying a tasty beverage down at the pub with the proceeds (with every party to the transaction and the delivery of the electricity made good)?

The answer is not instantly.

Firstly, P2P electricity trading often requires some form of staking to manage credit risk, in the same way that the our current electricity markets requires retailers and other market participants to demonstrate they have credit support and can meet their prudential requirements.

Secondly, once a transaction on the P2P blockchain network is validated, which will take time, we have to wait for the transaction to propagate across the network and wait until we have confidence that the transaction is finalised.

Thirdly, P2P, at least as far as all current trials and products are concerned, does not deliver a complete self-contained market: P2P it operates within the context of the existing electricity market. So once the P2P transactions are settled, we still need to wait for the conventional market to settle.

Lastly, once I have received my tokens or had my staked tokens released, I need to convert them back to real money to use them outside the P2P platform, which will take time (and may incur transaction costs).

So, and hopefully I'm not labouring the point, if our goal was real-time market settlement then that would be much quicker and easier to deliver with a centralised platform than with a blockchain platform; and ideally a centralised platform that encompassed the entire electricity market (more on this below).

Markets within markets

In a famous 'tweet storm' Naval Ravikant provided a manifesto for blockchain, starting with:

1/ Blockchains will replace networks with markets.

This speaks to what is perhaps the main benefit of blockchain for applications beyond digital money: creating new markets for services that could be delivered using a blockchain network. It also seems very applicable to the power grid, which is of course a network!

The tweet storm goes on to say:

20/ Blockchains are a new invention that allows meritorious participants in an open network to govern without a ruler and without money.

21/ They are merit-based, tamper-proof, open, voting systems.

22/ The meritorious are those who work to advance the network.

23/ As society gives you money for giving society what it wants, blockchains give you coins for giving the network what it wants.

24/ It's important to note that blockchains pay in their own coin, not the common (dollar) money of financial markets.

25/ Blockchains pay in coin, but the coin just tracks the work done. And different blockchains demand different work.

Inspiring stuff. The problem for P2P is that (a) we already have markets for electricity and (b) any value creation/capture cannot be intrinsic to the P2P markets - there can't be a 'natural economy' - it is only derived from the existing market.

What I mean is that the value of buying electricity from my neighbour comes from the avoided cost of buying it from my retailer. The value of selling electricity to my neighbour comes from the premium I might be able to obtain over a feed-in-tariff. Setting aside the fact that the real spread between the two amounts might be small, the key point is that the P2P market is not independent of the 'real market'.

The obvious rejoinder is we don't just want to layer P2P on top of or inside current electricity markets, we want to replace them. Viva La Revolution! Current P2P platforms are not remotely close to do anything like that. I also think its hard to make the case that doing so is even desirable: the fact that the electricity market is 'governed' is, in many respects, extremely desirable.

Vulnerable people and the regulators

One reason is to protect vulnerable people and society more broadly. Electricity is an essential service. If electricity is not delivered people die. If electricity is not affordable people suffer.

Even in Australia, with a relatively de-regulated electricity market, the industry and the market is heavily governed with comprehensive rules and strict controls. We have guaranteed access, price controls, and many other protections.

You might say we can just encode all of these controls and protections in smart contracts. But smart contracts are just computer programs (and even carefully developed software has bugs), and encoding all of the electricity market rules and regulations, and the associated operating practices would be challenging. And rules change fairly regularly. Part of the point of blockchain technology is to make things hard to change: and updating deployed and running smart contracts is no exception.

So if and when we can write flawless code replicating thousands of pages of complex market rules, regulations and operating procedures, and we have systems to safely and speedily update these rules when required, then maybe we could replace some or all of the current electricity market mechanisms with blockchain without putting vulnerable people at risk.

The 'rulers' in our current markets are regulators and market operators and they are guided by consumers best interests (vulnerable people and the rest of us). So I'm very skeptical about both the feasibility and the benefit of to 'disintermediating' these organisations.

The other piggies in the middle

If we're trying to find someone to disintermediate, the other piggies in the middle are the electricity retailers. As discussed in the first peer-to-peer electricity trading article, they do sit between consumers and the wholesale market, but they also provide some real value to the market and to consumers, and aren't just 'billing agents'.

There have been some outsized profits reported recently, like AGL's record "$537 million [profit] in the six months through December". However, this was more attributable to their generation business (and high gas prices, and the lack of investment in sufficient new generation capacity in recent years), rather than their retail business.

But we do have an oligopoly in Australia. The three big gentailers have around 75% of the National Electricity Market, and electricity prices are definitely increasing faster than inflation, so there is definitely the whiff of 'pigs at the trough'.

Pages and pages have been written about high electricity electricity prices in Australia, and one area to examine is retail administration costs and profits. We have a very liquid and transparent wholesale market and regulators who closely examine retail competition, so we can and do directly examine the cost of retail businesses facilitating access to our current wholesale market, and the regulator adjust rules and policies to encourage competition.

Perhaps unsurprisingly given its novelty, none of the reviews of high electricity prices in Australia have proposed blockchain and decentralisation as a solution to reducing electricity prices. If they were going to do so, there's two possible mechanisms.

Firstly, some people argue that blockchain and smart contracts can enable more automation of retail functions and so deliver lower administration costs.

One possible piece of evidence that this might be a way to reduce costs are 'peer-to-peer' providers like Gridplus in the US and Electrify.Asia in Singapore who are competing directly in the retail market under their own retail license. I fully support retailers investing in software and automation to reduce costs and improve service (I believe 'digital transformation' is the popular term). If using blockchain software has allowed companies like Gridplus and Electrify.Asia to operate more efficiently and so be more competitive and offer lower prices to their customers, then that's great.

But, I'm skeptical that these lower administration costs can actually arise from "blockchain". As a retailer they are necessarily still a centralised party sitting between their customers and the wholesale market. And as we've discussed traditional software platforms are simpler, faster, and probably still more secure. So I really can't see how a centralised software platform couldn't do exactly the same job quicker and easier than whatever they are doing with blockchain. If there's something I'm not seeing here, I would love to be educated.

Secondly, some people argue that blockchain and smart contracts could enable consumers to participate directly in the wholesale market. I actually think this is interesting and could be part of the future of peer-to-peer (discussed more below). However, we need to keep in mind that cost saving in the scenario arise because the consumer is taking on wholesale risk from the retailer (so it is not without a cost).

This is already possible without blockchain, and is already offered by alternative retailers like Flowpower (commercial) and Amber (residential) who provide a 'pass-through' product without the normal costs of hedging built in to the bundled price. So again, to the point above, there's nothing inherent to blockchain that enables this, although perhaps it provides some route to managing these contracts more efficiently??

So where does it make sense?

Software is eating the world, and the power sector is not immune, but blockchain is not the beginning and the end of software innovation in this sector. In some circles there seems to be the idea that blockchain is some sort of 'red pill', and that just saying 'blockchain' three times will disrupt everything. This just isn't the case, as I've tried to discuss above.

The most important characteristic of blockchain technology is that it enables decentralisation of (mostly) immutable data with a set of rules to agree how changes to this data can be made. If we want to create a solution for peer-to-peer electricity trading, this is just not something we need.

However there are probably areas where blockchain does make a lot of sense, and could be applicable to the power sector, for example:

- Environmental certificate registry and trading (carbon and renewable energy certificates)

- Financial markets trading (for derivative products like 'caps' and 'swaps')

- Wholesale market settlement and clearing (currently provided by AEMO and ASX)

What these use-cases have in common is that they aren't trying to involve thousands (or millions) of end-consumers, they sit almost entirely in the digital realm, and they don't involve a need to try and measure and manage the granular/real-time physical flow of electricity.

We could explore these use-cases more, but for now let's return to peer-to-peer electricity trading (where, if it's not yet clear, I think blockchain is a complete red herring).

Imagining a peer-to-peer future

When we consider the future of P2P electricity trading, I observed that:

"There is an undeniable consumer interest in taking control and being self-sufficient. The big trend we are seeing in the power sector is a shift from centralised resources to distributed resources, and not just distributed in a physical sense, but distributed in an ownership sense."

I think the key question the power sector faces is this: if investment and control is shifting behind the meter (from big machines to small machines), then how should consumers be recruited into being productive participants in the electricity market without (a) overwhelming them with risk and complexity or (b) making one group of consumers cross-subsidise another?

Peer-to-peer electricity trading is one attempt at answering that question. Earlier in the article, I shared a typical pitch from a P2P proponent:

"The aim is that consumers who purchase their energy via the [the platform] have the added benefit of getting their energy for cheaper than they would from the grid (and it's green!!) and local producers (prosumers) earn more than they would selling their energy back to the grid."

I would say that if your peer-to-peer pitch is people "getting energy for cheaper than they would from the grid" (or in other words, offering a more rewarding solar feed-in tariff) then really you are arguing that retail competition isn't working (there is currently value being left on the table that can be offered up to P2P consumers). P2P isn't, by itself, creating new value, so if some consumers are better off with P2P then either they are being cross-subsidised by other consumers or retailers are giving up some margin to entice 'tech-savvy' consumers who are attracted to the idea of 'trading'.

Of course the other explanation is that P2P consumers don't actually get "energy for cheaper". I think this is entirely likely. Inevitably there will be some fee to participate in P2P platforms and/or some additional risk that P2P consumers will need to take on. Given there is hardly any or even no margin left on the energy being transacted between current feed-in-tariffs and competitive rates to purchase electricity, the cost of platform participation fees and/or additional risk will make these P2P consumers worse off.

We looked at five challenges that P2P could possibly assist with, and my sense is that there is one area that has the most potential for P2P ideas to help improve.

Supporting those who can't self-generate

Any electricity we are exporting is already used by our neighbours. If we accept that the economics of this exchange are already fair (or that improvements to 'fairness' sit outside the P2P realm, e.g. reform of network tariffs), then perhaps we can reframe P2P not as a way to get paid more for exported energy, but as a way of sharing and directing the benefit of exported energy.

For example, directing it to a specific neighbour, or family member, or local community organisation (effectively giving up some of the value of the feed-in-tariff to the recipient). This can be a reciprocal arrangement where, for example, some households or local businesses could elect to pay more for locally generated power, with the additional payments shared out amongst exporting consumers (as a premium on their feed-in-tariff).

What's less clear is whether a 'trading platform' provides the right kind of metaphor or user experience for this kind of interaction and value sharing, and whether it should be something entirely separate from the other interactions customers have with their retailers when they purchasing and selling their electricity. This is something that the P2P trials that are underway may prove out one way or the other.

There are many other ways of supporting consumers who can't generate their own electricity (e.g. solar leases and PPAs, community solar, community batteries, fractional ownership of energy resources, greenpower products, etc), and I think the real opportunity for retailers is to design much better and more flexible digital experiences to control where the energy we are consuming is coming from, and where we'd like the energy we export to go.

The electricity market of the future

Could there be an electricity market where we don't have regulators or market operators or electricity retailers as our 'representatives' in the market? Where everything is real-time and fully automated? Where our house and car and distributed energy resources automatically respond to changing market conditions? Where we automatically buy and sell electricity at the best rates and times?

Probably. Perhaps in twenty years? However, if and when this kind of future does play out it will have much more to do with artificial intelligence than blockchain. The role of AI in the power sector will be an article for another day 🤞.

Thanks for reading this far! ☺️